From Green Stimulus and the 14th Five-Year Plan to China's Modernization: Writing a New Growth Story Around Natural Capital

During the 14th Five-Year Plan (FYP) period, China will encounter the most complex and severe challenges in economic and social development since the reform and opening up. The short-term downward pressure will be increased by domestic structural, institutional, and cyclical problems in deepening reforms intertwined with the risk of potential reverse of economic globalization amid the global pandemic. At this stage, China may face a fundamental transformation in the drivers of economic growth. It is imperative to forge consensus on the "new growth" within the whole society and avoid or detour "old growth". China's new growth story should better promote high-quality economic development. While shaking off the reliance on resources, government investments and exports, a shift should be made from extensive economic growth with high resource input and environmental cost to green, low-carbon, and smart growth, driven by innovation. The new growth will facilitate dual efficiency improvement represented by information technology (IT) and energy industry revolution, and meet the people's increasing demand for a better life in a superior way.

1. What is happening in the world and China?

The global economy is experiencing a new round of industrial, energy and technological revolution. The new growth pathway characterized by smart, green, and low-emission development has emerged as the primary direction of global transformation. Since energy technology innovation forms the core of previous industrial revolutions, the major economies have fully realized that possessing and mastering advanced, smart, green, and low-carbon energy technologies means occupying the commanding heights of future energy development and even economic development. Green competition has become more intense, particularly in key areas such as industry, construction, transportation, and finance. The European Union and the United Kingdom are the first to vow to achieve climate neutrality (net-zero carbon emissions) by 2050. The European Union even regards the European Green Deal as a priority area for growth strategy and economic recovery, and plans to add 260 billion euros of investment (approximately 1.5% of the GDP) every year to boost the economy and employment by stimulating market development and technological innovation. The global markets related to climate change continue to expand. Globally, various market mechanisms for climate change mitigation keep growing. The overall scale of carbon emissions trading, clean energy investment, and green bonds has exceeded trillions of dollars around the world. The annual renewable energy investment of developing countries has outnumbered that of developed countries from 2015 onwards. Despite a reverse in the federal climate policy, a considerable number of states, cities, and enterprises in the United States are still actively pushing forward low-carbon transformation. Among them, 24 states that account for more than 50% of the population and gross domestic product (GDP) and 40% of the greenhouse gas (GHG) emissions have pledged to continue to fulfill the commitments under the Paris Agreement by establishing local emission reduction targets and investing in research and development (R&D) of low-carbon technologies. Democratic candidate Joe Biden suggested that the United States will achieve its climate neutrality target by 2050. Technology giants have also started to build a new Silicon Valley with the advantages of new generation information and communications technology (ICT) and energy technology.

China is about to enter the ranks of high-income countries as both the proportion of middle-income people and the share of consumption in growth keep rising. At the same time, the country will enter a moderately aging society. The corresponding changes in demand and consumption structures will reshape the original logic and pathway of growth. The traditional economic development model will be faced with the dilemma of demographic dividend loss, diminishing marginal investment benefit, and mounting environmental pressure. The expanding middle-income group will increasingly yearn for a good life featuring safety, health, happiness, and equality. This may lead to simultaneous structural changes in both demand and supply. In recent years, supply-side structural reform and high-quality development have been continuously strengthened with the new vision of innovative, coordinated, green, open, and shared development. At the implementation level, however, there is still a lack of strong institutional support. The reform has not yet yielded obvious results, with signs of rebound in economic policy implementation, especially in some local areas and sectors. As the first major country to enter the recovery stage and contribute more than 30% to global economic growth, China's economic stimulus plan to combat the pandemic has attracted much attention. There are arguments around those policy options under stimulus plan, mainly focused on whether China will add new factors and increase institutional inputs to support green and low-carbon manufacturing and new growth pathway, or still investing, in a simple extensive manner, in traditional high energy-intensive industries such as coal, electricity, steel, cement, and chemicals, as well as infrastructure. The choice that China is going to make will undoubtedly exert a profound impact on the effectiveness of China's supply-side structural reform and growth driver shift and even global long-term sustainable development.

In short, China should know what to do and what not to do for the coordination and balance of international and domestic contexts; long-term and short-term benefits; and security and growth during the 14th FYP period. Amid the dual revolution of ICT and energy, China should look into tunneling through the Environmental Kuznets Curve, and explore new growth drivers and paradigms for high quality recovery.

2. What is China's new growth story?

The 14th FYP period represents an important start for China's new journey to comprehensively build a great modern socialist country and achieve the Second Centurial Goal. Due to more prominent risks and uncertainties in more complex domestic and international situation, good performance in the five years of the 14th FYP will pave a solid foundation for China's dream of a powerful country of modernization, while misjudgment and detour will cost high economic, social, environmental price and even bungle the historical opportunity of this round of scientific and technological revolution and major change unseen in a century. Therefore, the overall tone of China's new growth story during this period is "turning crisis into opportunity, making progress while maintaining stability, changing with the trend, and striving for victory in change". In addition to "ingenuity" which refers to smart efforts, it is necessary to identify the general trend of development, burst through the mist of development behind the pandemic, and find the "right way" to long-term sustainable, inclusive and resilient development.

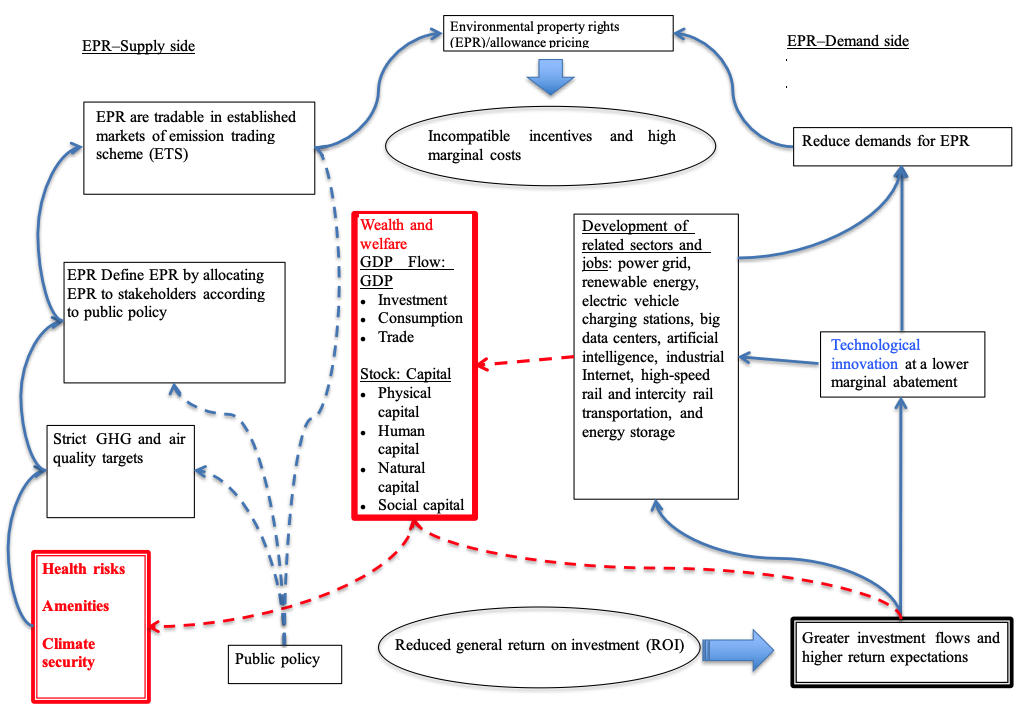

Figure 1 New growth story about natural capital

China's new growth story during the 14th FYP period denotes higher-quality, greener, more efficient and sustainable consumption and production; more open, inclusive and cohesive economy and society; and new civilized development in higher harmony with nature. The connotation and extension of national wealth will change rapidly along with the evolution of public demand. The share of natural capital will rise in the changing structure of physical, human, natural and social capital, making lucid waters and lush mountains more valuable assets. During the 14th FYP period, there will be a fundamental transformation in the driving force of China's economic growth. It is necessary to build a consensus on "writing a new growth story around natural capital" throughout the society. As shown in Figure 1, smooth institutional channels should be created to turn lucid waters and lush mountains to valuable assets. They are intended to form a positive cycle of supply, demand, technology, and policy with green elements as the core. The weak links should be synergistically reinforced, such as health risks, convenience facilities, and climate security. The property rights and the pricing, allowance allocation and trading mechanisms of natural assets should be clearly defined, so are the responsibilities and rights of the government, the market, and other social participants. More stringent environmental quality and climate change objectives will be adopted to simulate quality development. Incompatible incentives and high marginal costs should be addressed, to facilitate greater investment flows and higher return expectations in the field of green and low-carbon development.

Specifically, China's new growth story will present the following characteristics:

(1) Reshape high-quality, low-carbon productivity and competitive advantages. The new growth story is not limited to new infrastructure construction, and it will reshape the productivity and comparative advantages. The achievement of the Second Centurial Goal requires the efforts of several generations. The preliminary results of the new growth story of the 14th FYP period can and should be sustainable to allow future generations to enjoy both rich material and environmental wealth. Green and sustainable growth is the basic premise and important content of promoting ecological civilization and high-quality development. The pursuit of growth should not loosen the control of environmental degradation, climate change, and ecological degradation as the old path or modernization detour of developed countries. "Lucid waters and lush mountains are invaluable assets. Improving the ecological environment is developing productivity." On the one hand, it enhances human capital and development resilience by improving health and well-being. On the other hand, it brings development opportunities for green industries and technologies to leverage low-carbon investment and employment. According to FTSE Russell's estimates, in 2017, the green economy approximately accounted for 6% of the market value of global listed companies, reaching about four trillion US dollars. It has gradually been comparable to the fossil fuel industry in scale. China has made great progress in the new manufacturing field such as renewable energy and electric vehicles. In terms of market share and investment scale, China has secured the world's first position in recent years. Technological competitiveness also keeps improving. China accounted for more than 57% of the global renewable energy patents, far exceeding the United States (15.6%) and Japan (4.3%) ranking in the second and the third place respectively. IT-based, smart and green growth is experiencing the most critical stage like butterfly before getting out of cocoon. China should actively seize this opportunity to turn advantages into strengths and sharpen long-term competitive edges.

(2) Pursue cross-border industrial revolution and inclusive development. In this round of industrial revolution, technological progress in a single field is difficult to support the overall development, but integration, collaboration and innovation across technical fields can play a greater role. The boundaries between traditional technologies and between industries are gradually being broken to adapt to the rapidly changing world. The new generation IT technologies represented by artificial intelligence (AI), Internet of Things (IoT), and quantum computing blends with low-carbon technologies represented by new-type industries and cities, renewable energy, green buildings and transportation, giving rise to new industries and new formats. Though difficult to define with a single concept, these integrated technologies and development models are interacting to solve increasingly complex non-traditional global challenges such as public health and climate change. Multi-objective balance and systematic solutions are the core part of the new growth story, so more attention should be paid to socioeconomic multi-objective balance and cross-border systematic management, as well as cross-industry/sector solutions. The new growth story should not only fully tap potential opportunities, but also control possible risks to reduce inequality in transition and enable equitable access to share the results of development.

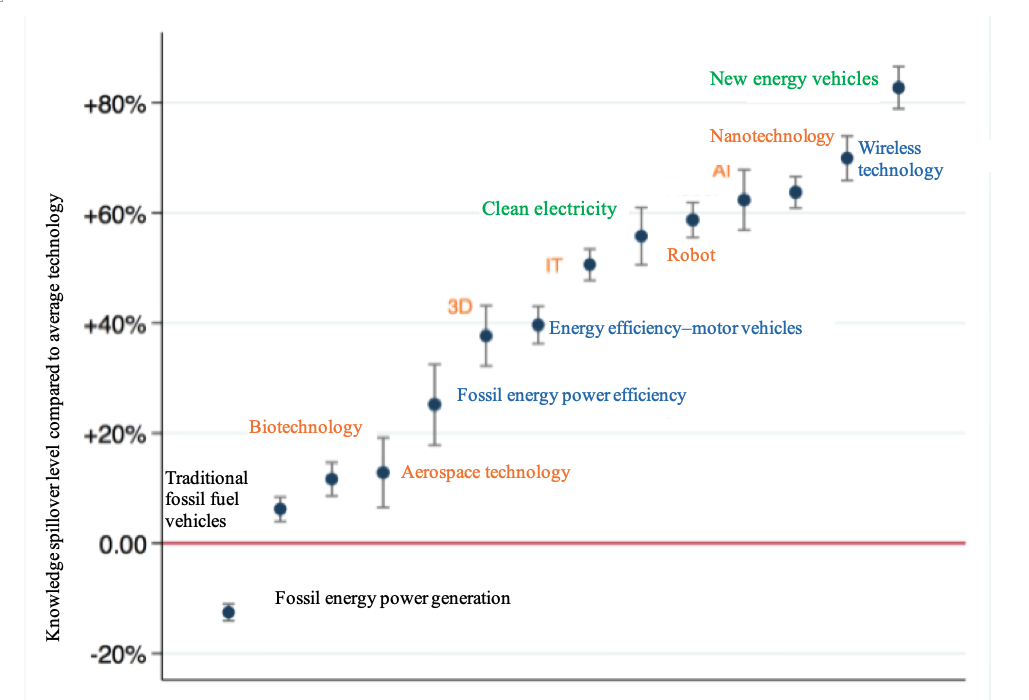

(3) Give play to the spillover effects of new factors such as technology, data and natural capital. Higher resource productivity is an important driver of the new growth story. Innovation is the main way to increase resource productivity. Human and intellectual capital can grow indefinitely through intellectual development, whereas physical wealth will be gradually exhausted when used. While improving human well-being, natural capital protection and investment can also serve as a lever that injects new growth impetus to emerging green industries such as smart grid, renewable energy, electric vehicles, and digital economy. According to the national wealth estimates of the World Bank, intangible capital accounts for 60–80% of the national wealth of most developed countries. In 1975, about 20% of the value of listed companies was intangible, that is ideas, knowledge, processes and networks cultivated by the companies. By 2015, the proportion rose to about 80%. The analysis on the contribution of different production factors and total factor productivity to China's economic growth shows that since the 1990s, technological progress has become an important factor driving China's economic growth. However, the contribution of labor productivity and new capital investment to China's GDP remains low, relative to the level of developed countries such as the United States and Germany. Many industries stay at the low or medium end of world industrial technology and value chain. Compared with traditional fossil energy and fossil fuel vehicle technologies, new energy vehicles, AI, clean power and energy efficiency technologies have a stronger knowledge spillover effect, which improves the innovation capacity of the whole society, as shown in Figure 2. Investment in human, knowledge, and natural capital helps China to take the lead in the new round of industrial technology revolution to sharpen long-term competitive edges.

Figure 2 Knowledge spillover effect of new technologies

(4) Pay more attention to openness and global consensus. The Covid-19 outbreak has further proved that the world swims or sinks together and becomes a community of shared future for mankind. No country can alone address this severe challenge. As the largest developing country, China not only acts on, but also inevitably shapes the world arena. Since the global industrial chain, value chain, and supply chain are intertwined, China's future development is crucial to the people of the country and beyond. With the increase of China's overall national strength, the international community has rising expectations of China on global issues such as public health, climate change, and development assistance. However, these issues cannot be solved by one country. Therefore, a global consensus on the new growth story needs to be forged on the basis of openness, mutual trust, and win-win cooperation. In cooperation with other countries, China will be fully able to meet new domestic and global sustainable development needs by investing in natural, human, and intellectual capital. It will boost green technology innovation and green industry development, provide high-quality public products for global ecological security, and share the green benefits from low-carbon development.

3. What should we do in the new growth story?

In the new growth story, we should focus on the introduction of short-term economic stimulus policies and the deployment of long-term development strategies, as well as the interaction between the two.

(1) New options for short-term economic stimulus plan

In the large-scale discussions on post-pandemic economic stimulus plan and 14th FYP, high hopes are placed on new infrastructure such as big data, cloud computing, AI, 5G, IoT, and Industrial Internet of Things (IIoT). The economic stimulus plan is intended to produce effects in the short term. However, new infrastructure, such as industrial Internet, IoT, and charging piles, highly depends on local economic and social foundation, and its scale and density should match local industrial needs and social governance needs. Without sound overall coordination and management, there will be redundant construction and idle capacity, resulting in large waste of idle investment and higher risk of structural imbalance. A fine example is huge excess capacity associated with the 4-trillion-yuan stimulus plan launched in 2008. In contrast, a reasonable and optimal economic stimulus plan that matches the long-term new growth story will maximize the long-term benefits.

From the perspective of new growth story, the economic stimulus plan should cater to China's high-quality development by better supporting new technology innovation and application and green industry and consumption upgrade. It should strengthen the new engines of growth while making up for the deficiencies. Meanwhile, it should avoid the lock-in effect of high-carbon infrastructure investment and the risk of massive stranded assets to pursue win-win in economic, environmental and energy transformation. Key/priority areas for investment and development under the stimulus plan are as shown in Table 1. It is estimated that investment added for the new growth story will surpass 40 trillion in the next five years, accounting for more than 50% of China's infrastructure investment and more than 10% of China's investment in fixed assets.

Table 1 Key investment areas under the economic stimulus plan

|

Category |

Priority areas |

Investment scale (2021–2025) |

Financing sources and channels |

|

Information infrastructure |

5G base stations |

2.5 trillion |

Public and market-based debt and loans |

|

Artificial intelligence and big data center |

2 trillion |

Market-based debt, loans, and stocks |

|

|

Industrial Internet |

0.8 trillion |

||

|

Renewable energy friendly energy/power systems |

Centralized/distributed renewable energy, flexible power system, smart grid, etc. |

4.7 trillion |

Public and market-based debt and loans |

|

Green and low-carbon urbanization and modern cities |

High-speed railway and intercity transportation of city clusters, electric vehicle charging piles, clean heating and cooling, low-carbon buildings, public service facilities, etc. |

7.8 trillion |

Market-based debt, loans, and stocks |

|

Digital upgrade and green transformation of traditional industries |

Digital applications for specific scenarios; Electrification of specific sectors and processes; Integrated supply chain restructuring for small and medium-sized enterprises (SMEs) in specific regions and city clusters; Environmental quality improvement and ecological restoration (considering carbon emissions) |

16.5 trillion |

Market-based debt, loans, and stocks |

|

Expansion and reshaping of green consumption |

Consumption of green and low-carbon products: energy-efficient appliances and electric vehicles; Low-carbon lifestyles in smart cities: medical care, elderly care, sports, education/training, entertainment |

5.5 trillion |

Public and market-based debt, loans, and subsidies |

|

Innovative infrastructure |

Major science and technology infrastructure, science education infrastructure, industrial technology innovation infrastructure |

0.3 trillion |

Public and market-based debt and loans |

(2) New thinking on the development of metropolitan areas and city clusters

Promoting People-oriented green urbanization. China's urbanization problems, such as traffic congestion, unequal service, and environmental pollution, reflect the uneven spatial distribution of population and economic activities and the deficiency of corresponding infrastructure and security measures. For new urbanization during the 14th FYP period, China needs to further identify the trends of demographic changes and the associated climate and environmental impacts, and make plans in advance for the sustainable development and green development in key areas, while encouraging green urban lifestyle, and innovation-driven development of consumer infrastructure represented by medical care and education. In addition, China should explore the construction of modern social governance structure, advance the reform of fiscal and tax system, with a focus on establishing local self-sufficiency fiscal cycle, so as to fundamentally address local government's dependence on land finance. Effective public fiscal tools will be launched to facilitate the balance between investment and consumption and guide investment flow to sustainable infrastructure.

Facilitating construction of smart transportation infrastructure. Transportation technology transformation based on the characteristics of electrification, intelligence sharing and interconnection will inevitably exert profound impacts in many aspects, including passenger and freight transportation services, infrastructure construction and management, distributed energy and smart grid, land supply and parking management, urban planning, and AI. Through multi-party collaboration, comprehensive and systematic pilot programs should be organized as early as possible to forge clearer insights and rules and ultimately achieve optimal systems. More facilities such as light rail, maglev and suburban rail, as well as high-speed rail in city clusters will be planned and constructed. Such energy-efficient, large-capacity and rapid transportation mode will guide the intensive layout of cities and city clusters to foster an intensive and low-carbon transportation supply pattern.

Intensifying building renovation and functional enhancement. The combination of structural reinforcement and delicate renovation will be applied to provide functional upgrade, minimize energy efficiency, and adapt to the economical model. At the same time, financial incentives will be offered to encourage the construction of new buildings that meet high energy efficiency standards. During the 14th FYP period, the overall scale of buildings should be reasonably controlled, including the reduction of excessive construction. Financial subsidies will be introduced to support large-scale duplicable renewal, upgrade, and renovation projects for existing buildings and old cities. According to building characteristics of different types in various regions, the space resources on the outer surface and facade should be used to the maximum extent to develop photovoltaic power generation and sporadic wind power generation. Flexible power system buildings featuring “photovoltaic system, direct current, power storage, smart terminal, and intelligent charging piles”, and new rural power systems featuring “direct current microgrid and distributed renewable energy” will be promoted.

(3) New perspective from IT-based energy transformation

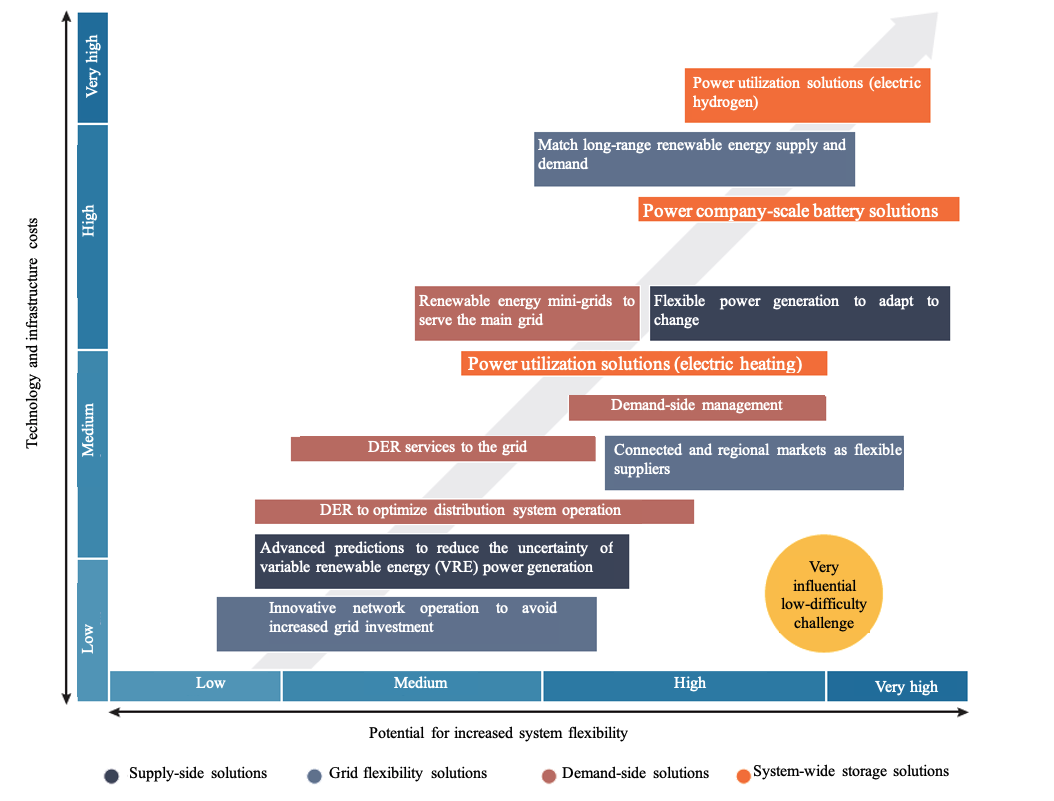

Deep integration of ICT with energy technology. The digital revolution with Internet IT innovation as the main direction has expanded from transmission grids to low- and medium-voltage distribution networks, and even affected individual equipment, making it possible to dynamically match supply and demand on the supply and demand sides. Compared with supply-side flexibility solutions, such as coal power electricity and centralized energy storage, the system flexibility solutions that fully harness the grid side and demand side have advantages in cost and feasibility (as shown in Figure 3). During the 14th FYP period, China will need to formulate forward-looking target and policy frameworks to meet the needs of future power systems. It should actively promote the application of modern information technologies and advanced communication technologies, such as cloud computing, big data, IoT, mobile internet and AI, in system operation control and end-user integrated energy services. China should facilitate the bidirectional flow and sharing of energy information, and realize point-to-point autonomous transactions between distributed energy resources (DER) and distributed energy storage entities and large industrial users and individuals and household-level micro energy consumers. Besides, the cross-disciplinary integration of renewable energy power supply, electric vehicles, heating and cooling systems should be strengthened.

Figure 3 Technical costs of grid flexibility solutions

Transformation from centralized power infrastructure to centralized and distributed integration infrastructure. Distributed power generation technology has been matured and ready for large-scale application in densely populated central and eastern regions with robust electricity demand and high electricity price. Without transmission costs and losses, in-situ consumption of distributed energy in the eastern region has certain economic advantages compared with centralized long-range transmission, as shown in Figure 3. During the 14th FYP period, China should change its past pathway of base-type large-scale development, and simultaneously optimize the energy spatial pattern and structure by vigorously developing distributed new energy systems such as photovoltaic and wind power. This will create a pattern of distributed and concentrated utilization, in which large-scale centralized utilization organically combines with distributed production and in-situ consumption. Grid construction will place focus on distribution networks while avoiding investment and expansion of alternative current ultra-high-voltage power grid. With attention paid to change in the strategic targets for energy development, a high percentage of self-sufficiency in the newly increased electricity demand will be achieved in the central and eastern regions.

Strict control of new investment in coal power. Currently, more than half of China's coal-fired power plants are not profitable. The blind investment in coal power faces long-term stranding risks, though it may generate short-term economic benefits. During the 14th FYP period, China should control the incremental investment in coal power, and strengthen the assessment of the economics of coal power, the financial risk of coal investment, and the possibility of stranded assets. In the meantime, the central bank and financial regulatory agencies should fully play the role in guiding capital flow and catalyzing the flexibility of financial system, to ensure that the long-term risks of coal power investment are fully reflected in micro-prudential and macro-prudential supervision to freeze incremental capital investment in coal. The supply-side reform of coal power will be advanced, primarily focused on the capacity optimization of existing thermal power units and the proper disposal of decommissioned thermal power units. China will promote the absorption of renewable energy and the development of integrated energy as guide, to realize efficient use of existing units and equipment by finding new profitable points for thermal power units

(4) New reform of economic governance and macro-control modernization

We should promote the definition of property rights of natural capital and the trading and market pricing, and establish an environmental and economic incentive policy system with compatible incentives. We will move faster to construct the property rights mechanism for factors, and realize property rights in an innovative way. The rights and interests of natural capital owners are protected, and the benefits of natural capital will be shared in a fair manner. We will deepen the market-oriented reform for the allocation of natural capital resources. Sound trading system and platforms will be established for environmental rights and interests to facilitate the trading and pricing of natural capital in the factor market, so as to achieve effective market allocation and ensure return on investment. We will accelerate the construction and stable operation of national carbon market by advancing the top-level design and formulating the development roadmap while consolidating the legal foundation. Mechanisms will be created to link the carbon trading scheme with other resource and environmental rights trading systems such as energy use rights and pollutant discharge rights. Taking advantage of the carbon market, we will encourage innovation in carbon financial products, which is in alignment with green finance, to provide financial assistance for the real economy, especially SMEs.

We should push forward green fiscal and tax reform, and release clearer and more stable policy signals to the market, so as to substantially boost investment in natural capital. The natural capital accounting system will be built up to fully reflect the scarcity of natural resources, as well as corresponding fiscal incentives and regulatory models. Meanwhile, a special financial performance evaluation mechanism for climate and environment-related public fiscal budgets and subsidies will be established. While scaling up public finance for the green field, we are able to mobilize and encourage more social capital to invest in high-tech, high-efficiency, and low-emission industries, and effectively divest from high-input, high-emission, and unsustainable investments. In terms of taxation, carbon dioxide will be included in the scope of the Environmental Protection Tax Law, and inefficient subsidies for fossil energy will be phased out.

We should accelerate financial reform and innovation, and promote the coherence and integration of green financial policies with industrial policies and climate policies. A favorable institutional environment with supporting measures will be created for the development of green finance, including mechanisms for reward and punishment, information disclosure, and third-party verification and supervision, as well as environmental and climate information disclosure mechanism and data sharing platform that serve green finance. In alignment with green financial standards, a standard system and associated supporting measures will be established for climate investment and finance. In addition, the environmental and climate risk assessment will be strengthened, especially the climate risks of those investment and financing to the energy-intensive industries such as coal, heavy industry, and thermal power. A macro-prudential impact transmission and response mechanism is also needed to deal with climate change risks. Standards for greening overseas investment and compliance accountability mechanism of financial institutions should be put in place. Besides, systems and mechanisms that promote green consumption should be improved to meet the people's growing needs for a beautiful ecological environment.